Clicklease approves customers who are overlooked by traditional financing options—like customers with poor credit or start-ups with limited time in business. We take a chance on these customers—helping them fund their small business dreams.

Clicklease isn’t just a “bad credit option.” Even customers who could get approved elsewhere often choose to finance with Clicklease. Here are just a few reasons:

Clicklease is quick, easy, and convenient—perfect if they need same-day equipment.

Clicklease payments make it easy to budget and measure ROI.

Leasing maintains credit lines and cash flow, so small businesses can use those resources for day-to-day operations.

We don’t require a down payment, but we do charge a documentation fee at the time of signing. The documentation fee typically ranges from $79 to $499 depending on the size of the lease. This “doc fee” is not a down payment and doesn’t go towards the balance of the lease.

Customers select their equipment and apply for Clicklease. When the customer is approved, they review and sign a lease agreement. Then Clicklease buys the equipment directly from the seller partner for the full invoiced amount. The customer leases the equipment directly from Clicklease, so we handle everything once the customer receives their equipment.

Business equipment leases work a little differently than the leases customers may encounter in their personal life. When someone leases a car, they bear limited responsibility for maintenance and liability. When the lease term is up, they return the car with no right of ownership. (Though some auto leases do include an early purchase option, it’s usually cost-prohibitive.)

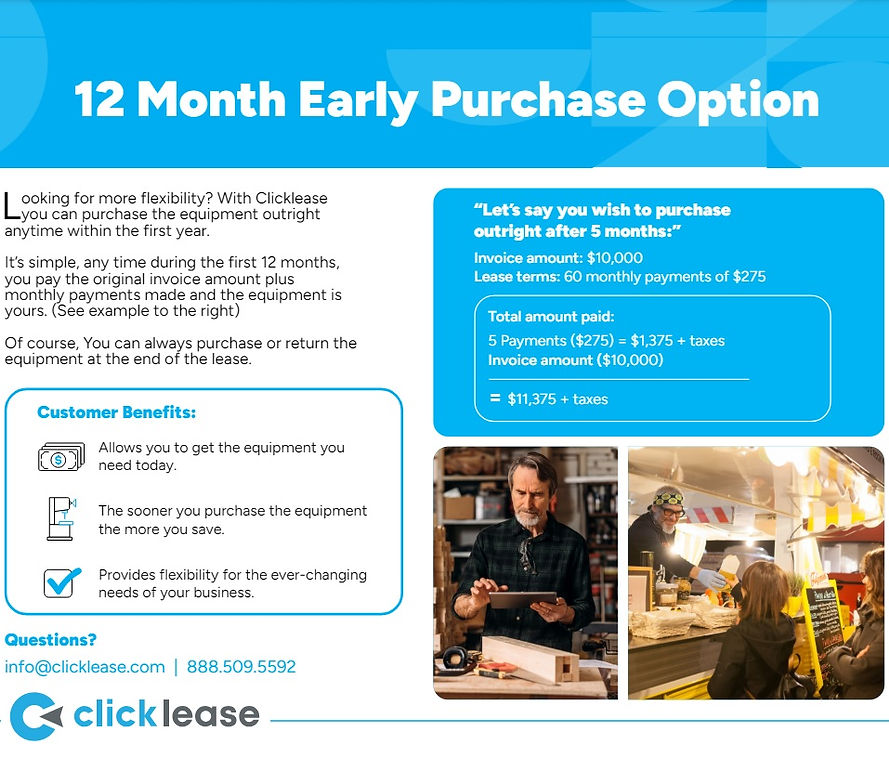

At Clicklease we build an early purchase option into every lease agreement. Typically, at the end of the lease term, the customer makes three more monthly payments, and then they own the equipment outright. The customer is also responsible for maintenance and repairs throughout the lease.